Stocks notched their fifth week of decline as tensions surrounding the Ukraine situation showed no sign of de-escalating, and inflation numbers out of the USA came in at a 40-year high.

The CPI for February released midweek showed that prices rose 7.9% from a year ago, the sharpest pace of growth since January 1982. Excluding food and energy, both of which moved sharply higher during the month, core inflation still rose 6.4%, in line with expectations but the highest in 40 years. Gas, groceries and shelter were the biggest contributors to the CPI gain. Despite being the fastest gain in 40-years, these numbers were for the month of February when the impact of the Ukraine war has not yet been factored in. The March numbers are thus expected to climb even higher as the rise in Oil and commodity prices get tabulated in.

The event risk of the upcoming FED meeting this Wednesday sent investors rushing to get out of the stock market as market watchers are unsure of how the FED will balance high inflation against the economic uncertainty posed by the Ukraine war.

For the week, the Dow lost 2%, the S&P 500 fell 2.9%, and the Nasdaq slid 3.5%. While the performance of US stocks seemed bad, the situation in Hong Kong was a lot worse. Continuing its descent from the week before due to the worsening COVID-19 crisis in Hong Kong, the Hang Seng Index lost 6.5% last week. Since the beginning of March, the HSI has lost a whopping 13.5%.

While stock indices were an easier trade as they simply cruised lower, the commodity complex showed huge volatility, with intra-day price volatility surging to around 20% midweek as conflicting news and analysis on the impact of the sanctions on Russia would have on commodity supplies appeared.

Commodity Prices See Historical Intra-Day Volatility

After gapping up and moving further north on news of USA’s ban on Russian oil imports, the price of Oil rose initially, before tanking in a sudden move on Wednesday, giving back most of its wartime gains amid indications of possible progress by the U.S. in encouraging more oil production from other sources. Reuters reported that Iraq said it could increase output if OPEC+ asks. Last week, the International Energy Agency released 60 million barrels of oil reserves to compensate for supply disruptions following Russia’s invasion, and the agency called the move “an initial response” and said more could be released if needed.

This has caused traders to rush out of the door as most thought the recent rally was getting ahead of itself. Both Brent and Crude oil fell around 25% from their highs to give back almost all their gains for the week, which was a two-way swing of around 25% each way in just one week. Both Brent and Crude have opened the new week falling further, down around 3% at the time of writing.

Time to trade OilWheat price also gave up almost all of its gains after reports of bumper harvests in Brazil and India, which could mitigate the impact of wheat shortage caused by the Ukraine war. In all, wheat also showed similar moves as with oil, with intra-week movements of more than 25%, demonstrating extreme volatile conditions in the commodity markets as contradicting news made traders confused over where prices could be headed.

However, the action in the energy and wheat markets were no match to that of Nickel, which saw price surge 100% in 2 days on the LME before trading on the metal was suspended.

Precious metals told the same story, with Gold surging near to its ATH of $2,100 before dropping fantastically back to $1,972, while Silver hit a high of $27 before dropping back down to $25.60.

On the currency front, the main news came from Europe. In its regular monetary policy meeting last Thursday, the ECB left all its monetary policy measures unchanged and trimmed back its APP bond purchases further, signalling hawkishness. This move managed to salvage some losses from the EUR/USD, which recovered to close 1% higher from its low of $1.08 hit early week.

Cryptocurrencies on the other hand, did not seemed moved by the events happening in Europe but traded based on their own fundamentals. That did not reduce the volatility in the crypto market however, as the price of BTC surged around 8% early week, only to fall by the same magnitude at the end of the week.

Traders Uncertain Over Impact of Crypto Executive Order

On Tuesday, the much-anticipated Executive Order in the USA to support to development of digital assets had finally been signed by US President Biden, bringing cheers to the crypto community. This caused the price of BTC hopping up $3,000 to $41,000, leading the other cryptocurrencies higher, and resulting in total liquidations of $53 million in one hour.

This Order will have several components, all of which are centred around studying cryptocurrency and digital money across multiple US government departments and agencies. Specific topics include central bank digital currency and the environmental impact of cryptocurrencies. While not expected to be influencing cryptocurrency prices directly, the enaction of this order was seen by market participants as a first step towards the eventual adoption of cryptocurrencies by USA.

However, as market watchers pored through details of the order, fear took over the mind of traders as many became worried about the chances of tougher regulations on the crypto sector. As a result, just as suddenly as prices have jumped, crypto prices tanked the next day, with BTC dropping back to $38,000, liquidating around $57 million within one hour.

Use leverage to hedge your BTC risks

Slight Inflow Increase To Crypto Funds

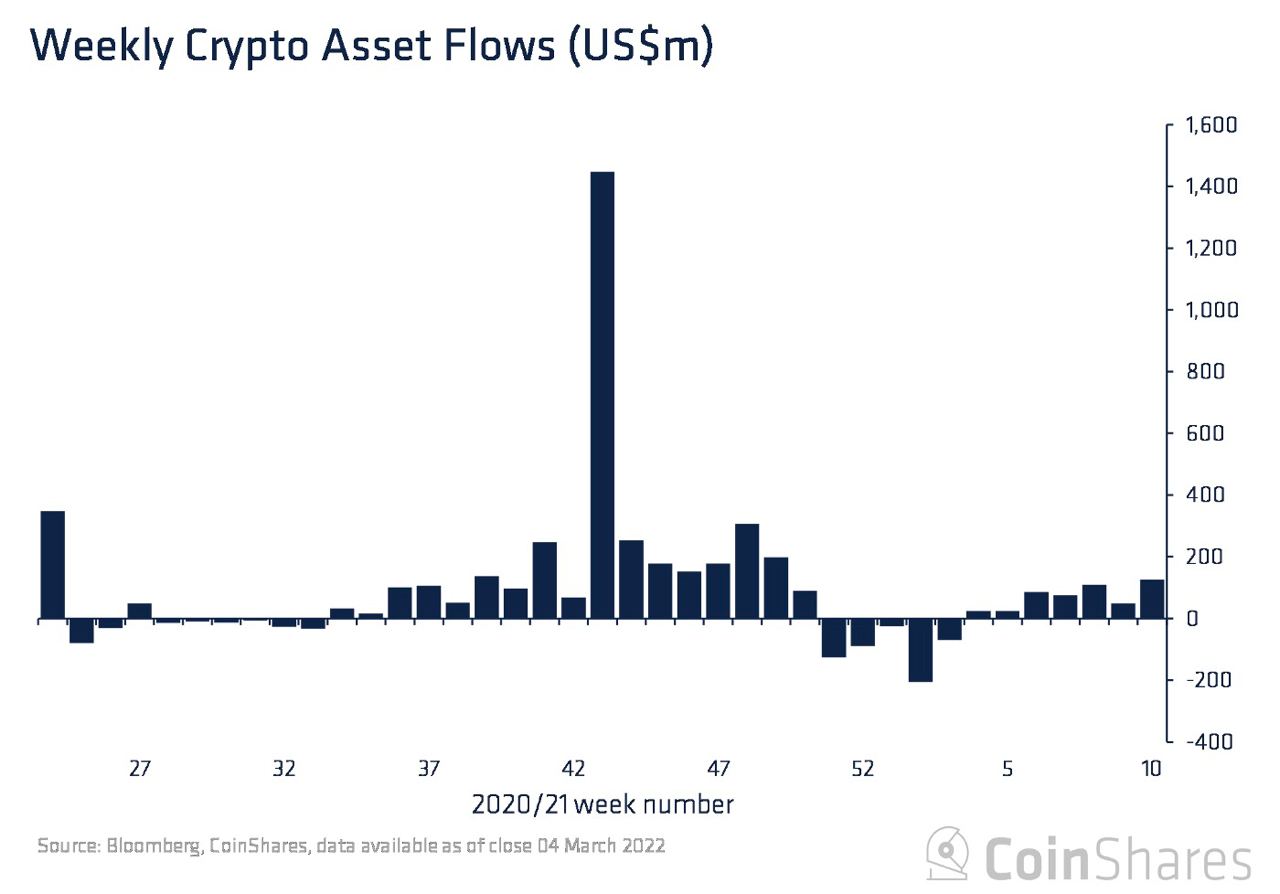

The start of sanctions on Russia has brought an increased inflow to crypto assets in spite of the risk-off environment.

Digital asset investment products saw inflows totalling $127 million in the week of 1st March, a day after sanctions were imposed on Russia, suggesting some investors are rotating into digital assets perhaps as a way to hedge against currency fluctuations.

Bitcoin saw the highest inflow amongst all, totalling $95 million, the largest single weekly inflow since early December 2021, and has now seen 7 consecutive weeks of inflows on a slowly increasing amount invested.

BTC Traders Undecided Over Direction Of Asset

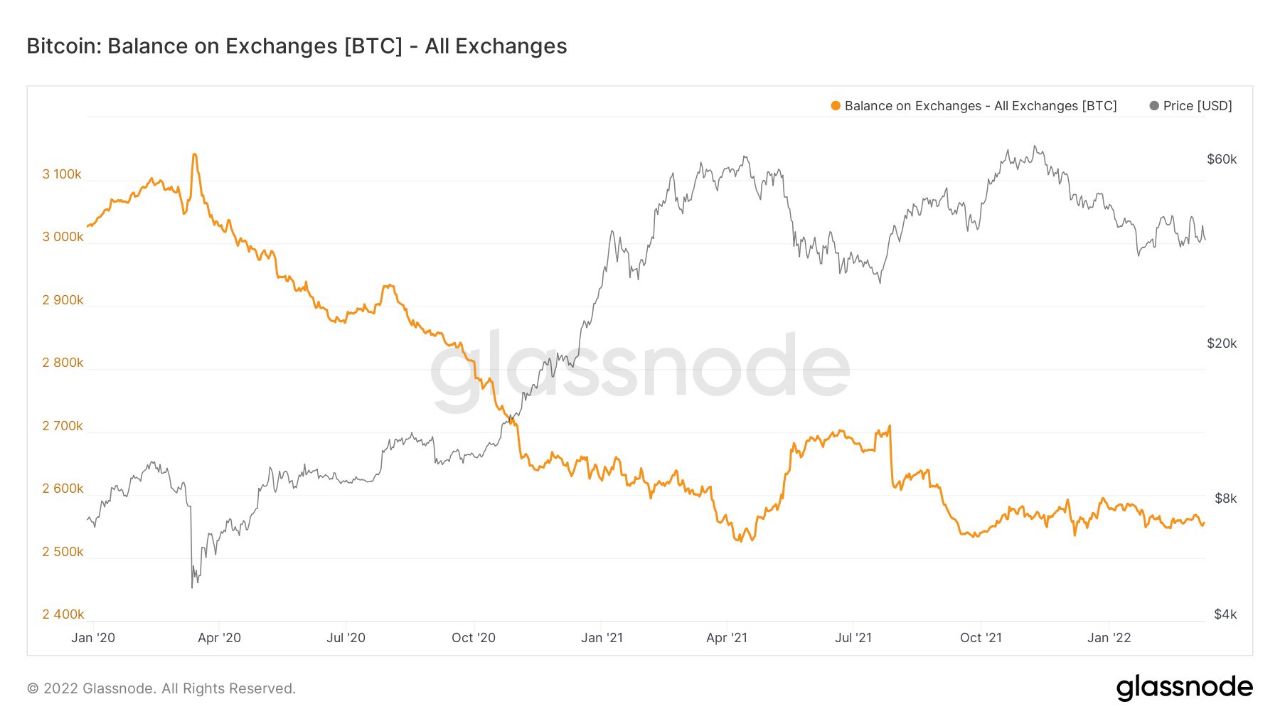

While crypto funds are showing some signs of life, the sentiment on the spot market continues to be indecisive as bulls and bears battle it out.

The aggregate balance of BTC on exchanges has also shown an undecided market, with exchange balance not showing any particular trend of inflow nor outflow.

This aggregate number of BTC at various exchanges stood at 2.357 million units as of Friday.

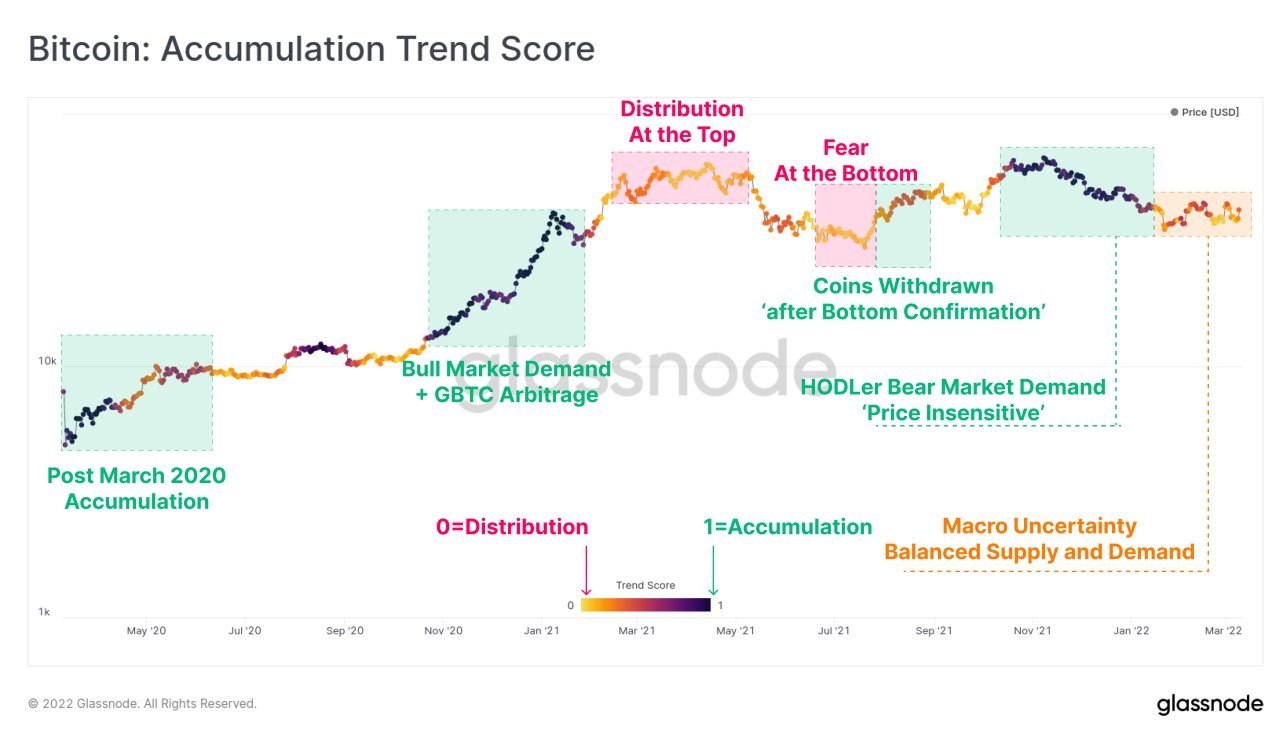

BTC Accumulation Trend also shows an equally undecided market, with no sign of accumulation. In fact, this score is showing a market currently in distribution as can be seen in the diagram below.

BTC Borrowing and Short Positions Increase

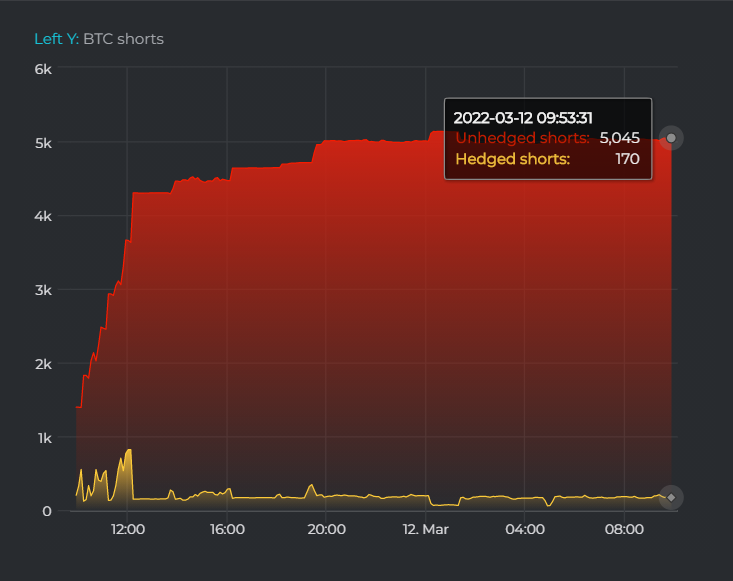

Recent data has also shown an increase in BTC borrowing. On Friday, it was revealed that some large investors have borrowed an additional 3,000 BTC from Bitfinex, presumably to prepare for opening new short positions. A total of 5,215 BTC have been borrowed and most of the short positions are non-hedging. As of Saturday, around 3,000 units of the borrowed BTC have already been shorted, giving other traders a valid reason to be bearish currently.

A new rumour could also have sent sentiment to a low. The news outlet Reuters, on Friday, claimed that many Russians are going to crypto exchanges in UAE to unload billions worth of BTC. Since no trade has been executed yet, crypto permabulls have dismissed the news as another piece of fake news.

Regardless, most traders appear to be putting up new short positions as the average BTC funding rate across exchanges have started to fall into negative territory. Traders may be lining up for a potential price drop due to the rate hike that is to come on Wednesday’s FED meeting. However, as funding rate is usually a contrarian indicator, the crowd being bearish may eventually lead to a short squeeze.

BTC Accumulation Ongoing Despite Poor Price Action

Despite the number of shorts increasing, the price of BTC has remained well supported, often rebounding from the $38,000 level as the third largest BTC wallet had been buying more BTC at around the $38,300 level over the past week. Moreover, a large number of BTC was also spotted to be leaving the largest USA exchange Coinbase, on Friday.

While such transactions could sometimes be an internal reshuffling of crypto wallets, Coinbase has yet to clarify this situation as of press time.

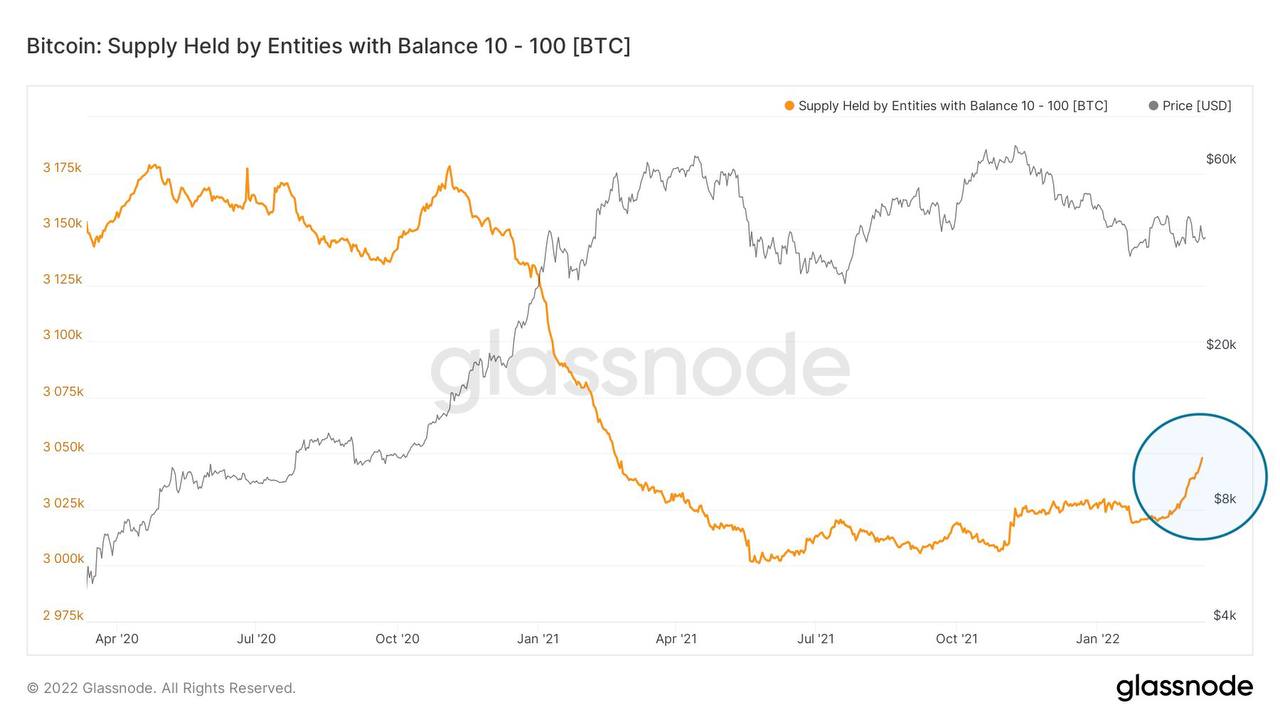

Smaller BTC whales that hold between 10 to 100 BTC are also acquiring more BTC, with the holdings amongst this group of whale surging significantly since mid-February.

While there has been at least a bit of positivity seen in the flow of BTC, the same cannot be said of the second largest cryptocurrency, ETH.

How to buy cryptocurrencies?

LUNA Gains Popularity At The Expense of ETH

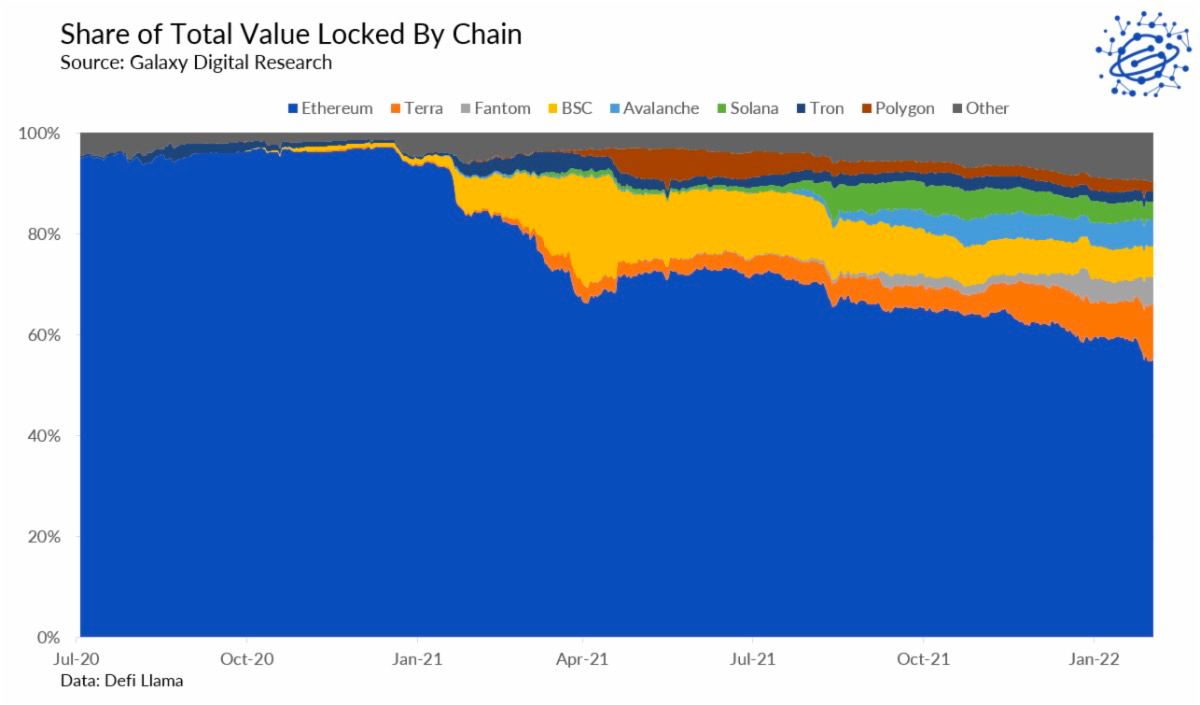

In the midst of competition from newer, lower cost and faster blockchains with higher yields, the TVL on the ETH blockchain has been dipping steadily, a sign that lesser and lesser investors are using ETH for DeFi.

ETH’s share of TVL is currently at an all-time low, trending below 55% for the first time ever. Last week saw an especially sharp drop in TVL on ETH, with a corresponding increase in TVL on that of the Terra blockchain (LUNA). This clearly shows that LUNA DeFi is getting more popular, while DeFi on ETH is losing attractiveness. While this is a good sign for LUNA, it may be the start of troubling times for ETH.

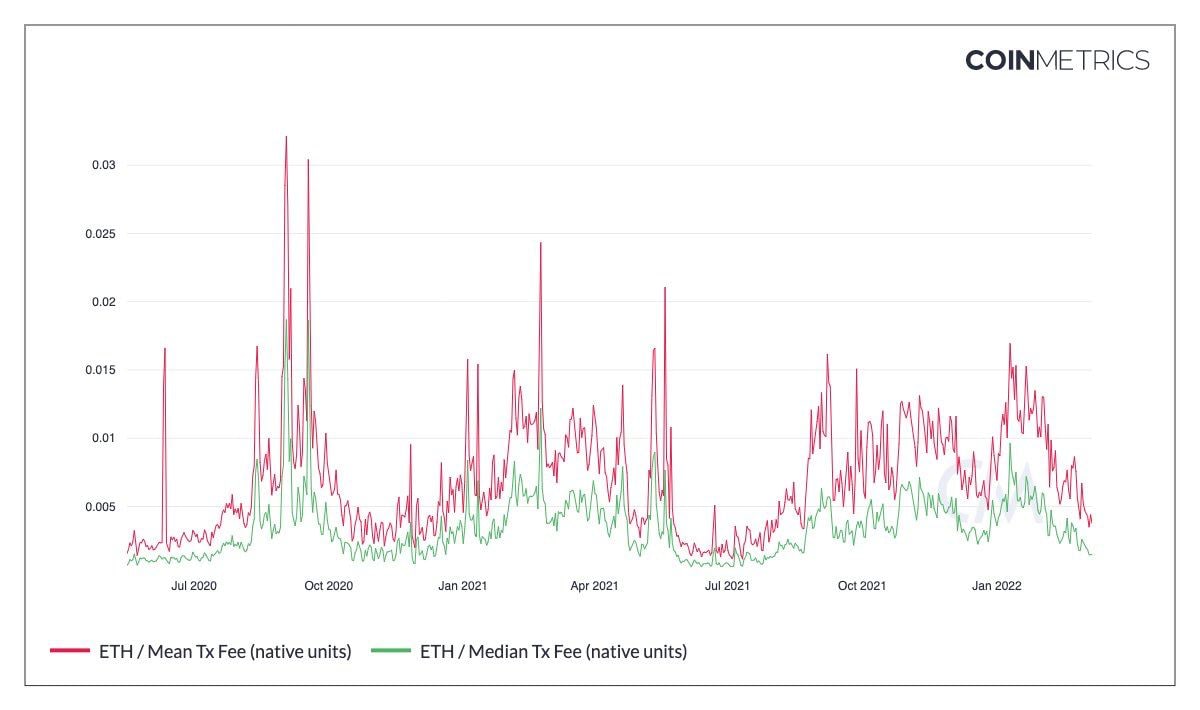

As interest in using ETH wanes, gas fee for doing transaction on the ETH blockchain has also fallen down to previous bear market level. This is not good news for ETH miners whose profitability will be hugely affected since network fees is a large portion of miners income. As a result of lower income and the ETH network moving to PoS, miners may switch to mine on other chains until their mining rigs retire. Miners leaving is also not a good sign for network security even though the network is now less reliant on PoW than before.

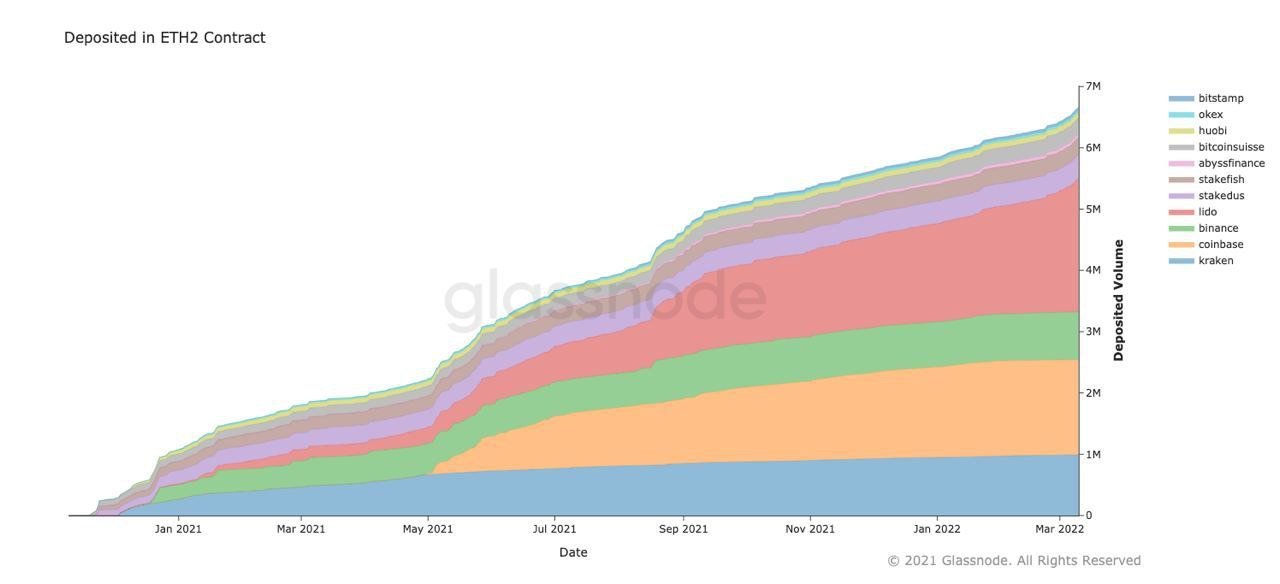

However, all is not lost on ETH as the staking on ETH 2.0 continues to grow. Around 10 million units of ETH, worth around $26 billion, have now been staked on the ETH 2.0 contract. After a lean growth period in January and February, investors have picked up pace to lock up their ETH to get 4.81% in staking interest at ETH 2.0 where they will become validators.

Amid what appears to look like a bear market, locking up tokens to collect yield while waiting for the next bull run seems like a prudent idea that could gain popularity as the market continues to consolidate.

Get income while waiting for the bull market

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.