Things have, recently, looked bright for the entire cryptocurrency space with Bitcoin not long off a new all-time high and Ethereum following that. Since Bitcoin hit a new high of $67,000, there has been some latent action from altcoins, including Ethereum.

The second-largest crypto by market cap also managed to break a new all-time high recently, crossing over $4,700. This also helped with other major altcoins as they rose, in some instances, quite impressively.

However, the cycle seems to be swinging back towards Bitcoin as the major coin has now bounced back at the start of the week, climbing from $60,000 to $66,500. A lot of this new rise in price has to do with increased good news in the crypto space.

Rumors that the SEC could approve Grayscale Bitcoin Trust’s (GBTC) conversion into a physically-backed BTC ETF helped push prices above $60,000. Even when the FED announced its tapering program, the com managed another small spike.

In other markets, a better-than-expected jobs report on Friday led stocks to yet another ATH after dovish FED comments on Wednesday started sending stocks higher. The month of October saw 531,000 job gains vs consensus estimates of 450,000, boosting the already positive sentiment post-Wednesday’s FED meeting.

The FED announced Wednesday it will begin reducing the pace of its monthly bond purchases at the end of this month, the first step toward pulling back on the massive amount of help it had been providing markets and the economy. The process will see reductions of $15 billion each month — $10 billion in Treasuries and $5 billion in mortgage-backed securities – from the current $120 billion a month that the Fed is buying. This is a mere 10% reduction and the market seems well-prepared for it as the stock markets rallied after FED chair Powell said that the economy is in very good shape.

All three major averages notched a winning week. The S&P 500 gained 2% last week, pushing its 2021 gains to 25%. The Dow rose 1.4%, while the Nasdaq rallied nearly 3.1% for its best weekly performance since early April.

Expectations about the impact US pressure could have on the Saudis to force them to increase oil supply caused the price of Oil to tank all week. However, that did not materialize on Friday as OPEC+ producers rebuffed the US call to accelerate output increase, and the price of Oil regained some lost ground on Friday to manage a fall of only 2.5% for the week. The price of Oil is expected to continue gaining since all hopes of a supply increase have been dashed and has opened the new week already up more than 1%.

Gold and Silver finally climbed after dovish FED comments, both gaining about 4% last week, and are a tad higher today.

Meanwhile, the House passed the more than $1 trillion bipartisan infrastructure bill Friday night, in time to send it to President Biden for his signature this week. The markets this week should continue their current optimism once President Biden signs the bill.

The Good News Keep Coming For Crypto Markets

News that the CME will be launching a Micro Ether Futures on December 6 led the price of ETH higher to carve out a new ATH of $4,640, while rumors that the SEC could approve Grayscale Bitcoin Trust’s (GBTC) conversion into a physically-backed BTC ETF kept the price of BTC above $60,000. Even when the FED announced its tapering program on Wednesday, BTC very quickly rebounded to above $62,000 when it flashed dipped to $60,000. This shows that there is strong buying at the $60,000 level for BTC.

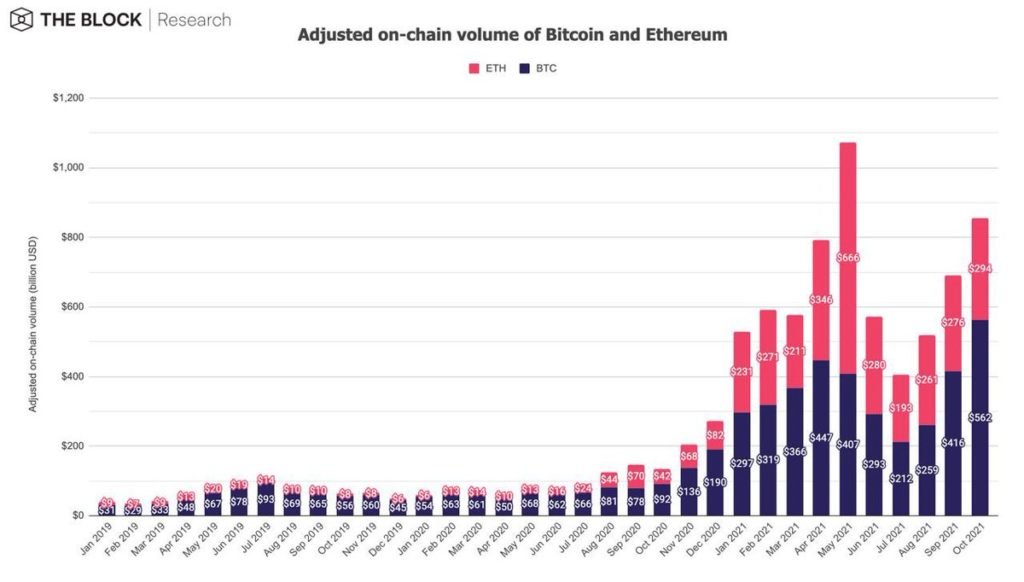

With a continued rise in the price of BTC and with ETH breaking out from ATH, the trading volume of both top coins has been increasing since bottoming out in July. The key point to note is that this volume is a 7-fold increase from barely just a year ago, and is a 10-fold increase from 2 years ago. Should the trend of rising volume continue, cryptocurrency trading could one day eclipse trading on the stock market.

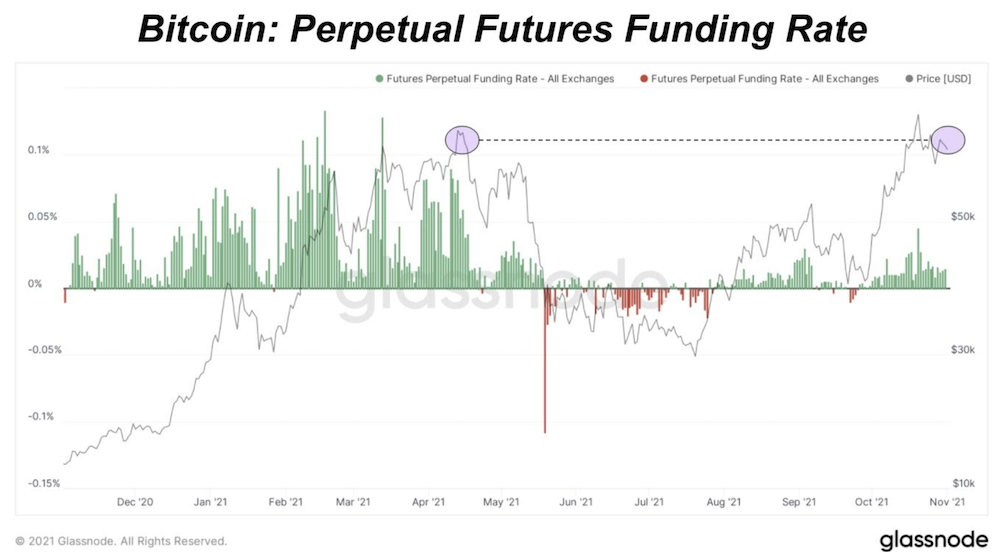

This Time Is Different For BTC

This time when BTC is above $60,000 is different from the last time BTC visited this level. In April when BTC first inched above $60,000, funding rates were markedly higher. This time, even though the funding rate is positive, it is sharply lower than that witnessed in April. Hence, this shows that leverage level is far lower now compared with April. This could mean BTC has a lot more room to move higher now compared with the April-May interim peak.

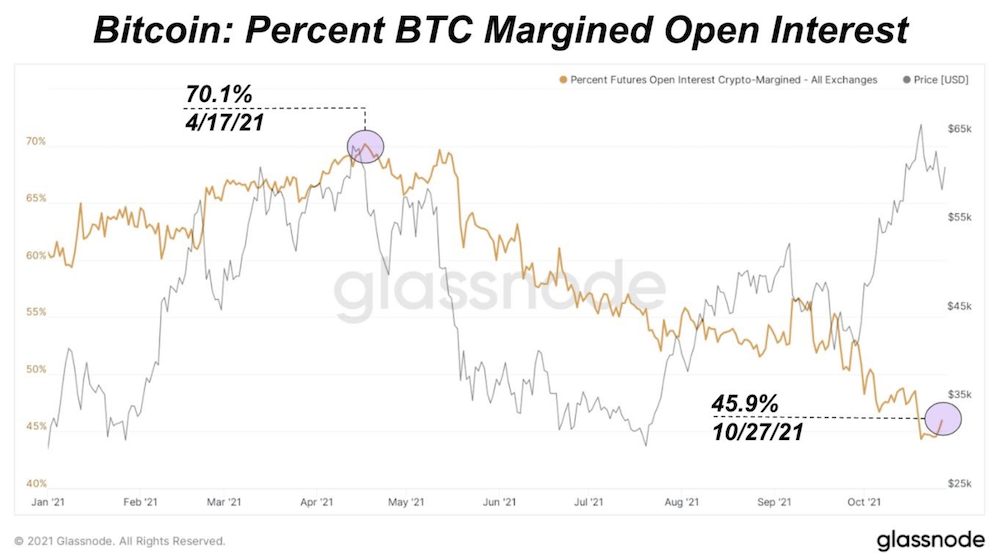

The average margin ratio back in April was 70%, while that now is only around 46%, a large reduction. In fact, the margin ratio currently is at the lowest level for the year, even lower than when BTC was wallowing at $30,000 in June. This shows the leverage level is at the lowest point of the year, which means that the doubling of BTC price from June to current is led by spot buyers, which have a higher propensity to hold than leveraged traders.

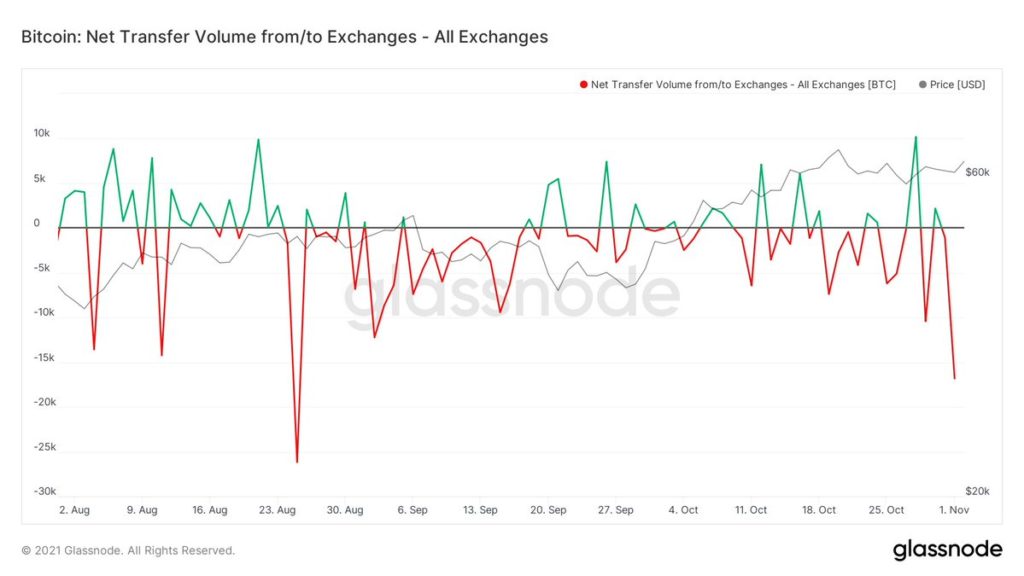

Despite price rising above $60,000 this time around, the amount of BTC transferred out of exchanges has been increasing and even saw a big spike in early November, showing that spot buyers have been buying BTC and moving them out of exchanges into storage.

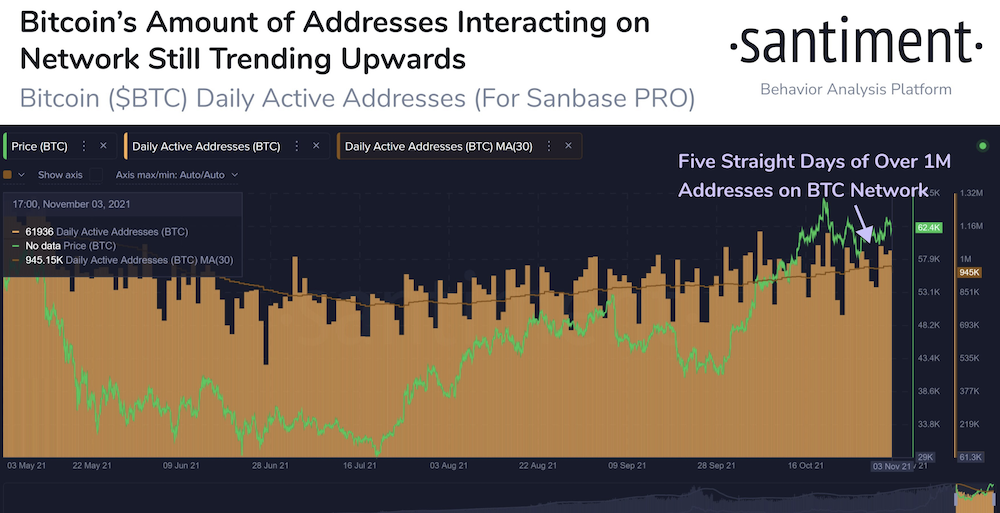

The number of transactions on the BTC blockchain is also increasing with the upswing in exchange outflows, suggesting that OTC transactions could be heating up. The first 5 days of November saw over 1 million active addresses moving BTC around. An increasing number of active addresses usually foretells a higher price ahead as the blockchain is very active, a sign of adoption.

As more BTC is being moved into cold storage, the illiquid supply of BTC continues to climb, with the number of illiquid BTC supply at the highest level ever, exceeding 14.52 million units. This means that we could be getting closer to the day the market realizes the BTC supply shock.

ETH Becomes Deflationary Ahead of Expectations

Not only is the supply shock for BTC intensifying, the supply situation for ETH is also tightening. The ETH network saw a negative supply for seven days straight from the end of October, meaning more ETH was burnt than what was being mined. According to data, the London hard fork led to the permanent destruction of more than 790,000 ETH, worth more than $3.5 billion currently. Taking this into account with the rate of new ETH being created, it puts the weekly net issuance of ETH at minus 8,034, meaning 8,000 ETH is being removed from circulation every week.

Most experts were expecting ETH to become deflationary only after ETH 2.0 comes into effect. The fact that it has become deflationary barely three months into the London Fork shows how much ETH is being used daily, and should be positive for the price.

Other Crypto News

Lately, almost all news flow related to cryptocurrency is positive as the nascent asset class gets recognized by more and more countries and traditional financial firms.

Australia’s largest bank, the Commonwealth Bank of Australia, is allowing the ability to buy, sell and hold crypto assets directly on its banking app, making fuss-free crypto purchases available to more than 6.5 million users.

Another country, Singapore, where much of Asian wealth is parked at, plans to become a hub for cryptocurrency and blockchain as its central bank chief sees a lot of potential in the industry. Singapore is currently hosting a week-long Fintech Festival till the end of this week where various influential people in the crypto world will be speaking.

Altcoins Take Turns To Rise, BTC Rises 5% On Elon Musk Rumour

Altseason continues to be the name of the game as various altcoins take turns to break higher. While many smaller cap coins like LRC and TRAC took turns to do 100% rises, larger cap coins also made significant headway. SOL broke its recent ATH of $218 to roar higher on the back of the start of the first Solana Conference this week, while AVAX also broke ATH after a custom-built AVAX version of the Etherscan blockchain explorer was launched.

News that Wrapped will be providing support for Wrapped XRP (wXRP) on the Ethereum blockchain starting December also sent the price of XRP rising briefly. This means that the XRP token will be able to participate in ETH’s ecosystem, which is music to the ears for many XRP holders who have been left out in the DeFi revolution. Perhaps it could be time for XRP, which has been left out for the most of this year’s market rally, to start playing catch-up with its peers.

Rumors of Elon Musk potentially going to make crypto purchases after he sells 10% of his Tesla shares has buoyed the price of BTC higher, up 5% as the new trading week begins in Asia. Keep a lookout for DOGE as well if Elon really says something about buying crypto.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.