China has been at the center of market movements this week as both the crypto and traditional markets are reacting to news coming out of the Eastern giant. For the crypto markets, the news is once again that China is trying to crack down, this time banning all transactions with digital currencies.

China has been one of the sternest nations when it comes to regulating cryptocurrencies, having banned them outright in 2017. However, the battle to keep Bitcoin and the likes at bay has not been entirely successful.

This has led to the country initiating more and more stringent blocks trying to limit their citizens having access to these assets. As expected, this has created mass-selling pressure and caused the price of many coins to drop drastically.

Early last week, fears about the Evergrande contagion sent assets in both the traditional as well as crypto market selling off.

However, markets rebounded by Tuesday as worries started to abate with news out of China that the Chinese government was relenting in their earlier stiff stance towards Evergrande’s default. Furthermore, optimism over FED policies led dip-buyers in to quickly buy up stocks that were deemed to be trading on a discount.

The market seemed to like what FED chair Powell said with regards to the taper program. With many traders expecting a taper on Wednesday, the fact that a taper would only begin next quarter seemed to sit well with market participants who took this to mean a still accommodative central bank. Powell said on Wednesday that the US central bank could begin tapering as soon as next quarter if economic numbers continue to show strength, and end the program by mid-2022.

Despite a scary start, the major US indices managed to close in the green for the first time in weeks. The Dow finished the week 0.6% higher, while the S&P 500 closed 0.5% higher. Tech-heavy Nasdaq trailed the other indices and only managed to add 0.02% for the week.

Investors have another 26 days before they find out if Evergrande will eventually pay $83 million in interest on a U.S. dollar-denominated bond that was due on Thursday. The company is staying silent and has a 30 days grace period from Sept 23 before it technically defaults.

Gold and Silver managed to score a bit of a relief rally as comments by Powell gave traders some breathing space before taking away its ultra-easy monetary policies. Gold trades at $1,760 while Silver is hanging on at $22.60.

Oil managed to climb all week, gaining more than 5% after bouncing off key support at $69 on Monday and looks poised to retest its high of the year at $76.50. Oil prices continue to thrive on supply constraints in the U.S. Gulf of Mexico, and also as a result of OPEC+ failing to agree on a supply increase. OPEC+ next meets on Oct 4 to discuss the issue and this could likely continue to put bids under Oil price. Oil starts the week 1.2% higher, closing in on $75.

To put an end to an already stressful week, crypto markets came under intense selling pressure for the third time in a week after China once again reiterated their ban on cryptocurrencies. On Friday, China’s central bank once again issued a notice that declared all cryptocurrency-related activities illegal.

BTC dropped more than 8% and ETH lost more than 10% at one point in reaction to the news before dip buyers out of the USA managed to salvage some losses. Crypto markets had already been under pressure since the beginning of the week when the Evergrande issue caused risky assets to sell-off.

Evergrande Contagion Hits BTC

The crypto market wasn’t spared from the Evergrande contagion and prices came tumbling early this week as the panic drove many traders to cut positions and leave the market.

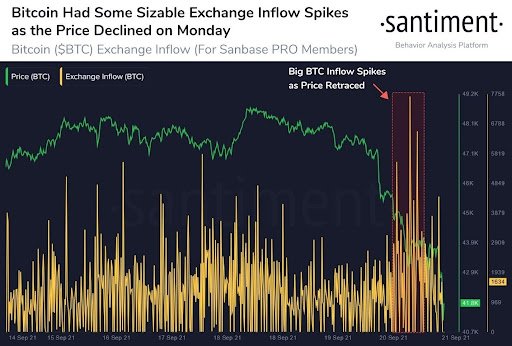

Inflows of BTC sent to exchanges saw one of its largest spikes in recent times on 20 Sept as the price of BTC came crashing down in tandem with the fall in stock prices.

An increase in exchange inflow of 2,000 BTC was picked up on-chain during the course of the biggest portion of the drop that happened on Monday evening that saw BTC price dip from $42,500 to $40,200. However, price recovered just saw fast as it had fallen to bring prices back above $42,000 within minutes.

In the same way that price had fallen, price recovered very quickly as an exchange outflow of 4,000 BTC was seen leaving exchanges 30 minutes after.

On Tuesday, the same thing occurred, with a quick sell down bringing the price of BTC to a low of $39,600, which was quickly absorbed by buyers who brought the price back above $42,000 within a couple of hours.

These incidents tell us that large accumulations were occurring at the $40,000 to $42,000 mark, which could lend strong support to the price of BTC. BTC even managed to stay above $44,000 for a while before news that China will ban cryptocurrency trading again for the 100th time sent prices reeling again.

Within one hour of the news, BTC fell by 4%, while ETH fell by 6%, and the liquidation amount in the market was around $100 million, not exactly a large amount. Altcoins, however, were more badly affected as most were down around 10% within the same timeframe.

Small Buyers Take Dip To Stack Sats

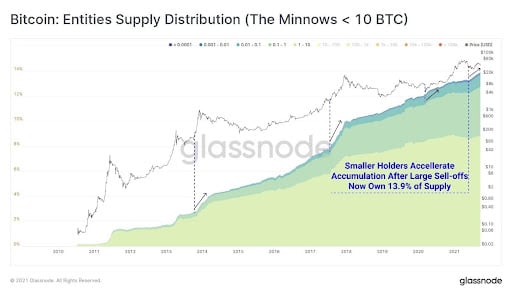

Amid the dips, small buyers were noted to be out in force nibbling at bits of BTC. The number of small hodlers with less than 10 BTC rose sharply last week amid the fall in price and continues to break ATH on a rising trend. This group of hodlers now account for almost 14% of total supply, which is a good sign of increasing adoption and a broadening distribution of owners, which is good for the long-term longevity of BTC.

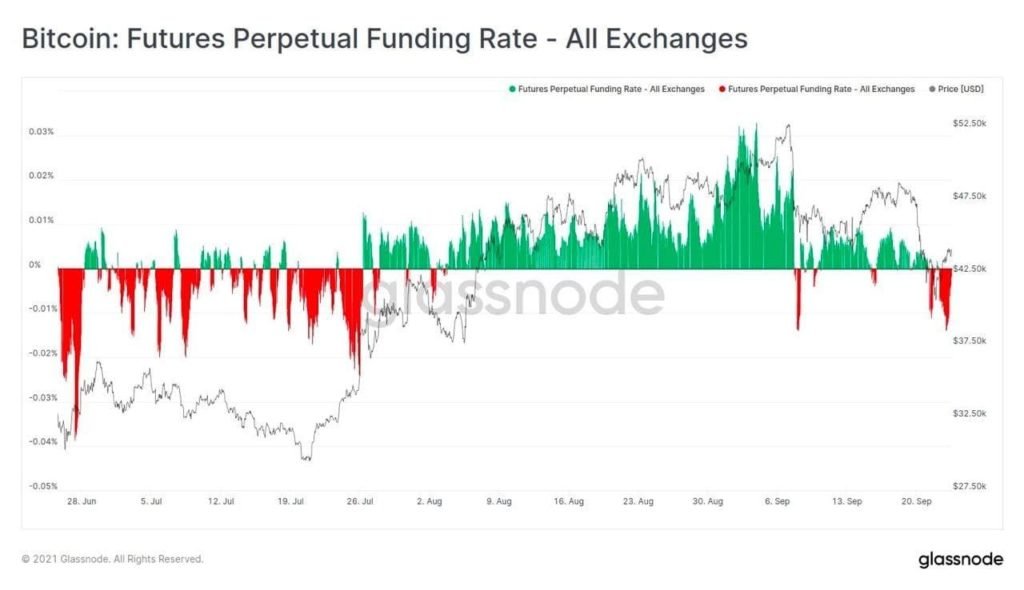

With a series of dips scaring the wits out of many inexperienced traders, funding rates at retail-focused exchanges have moved more deeply into the red, suggesting that most retail traders are bearish and have a preference to go short than long now.

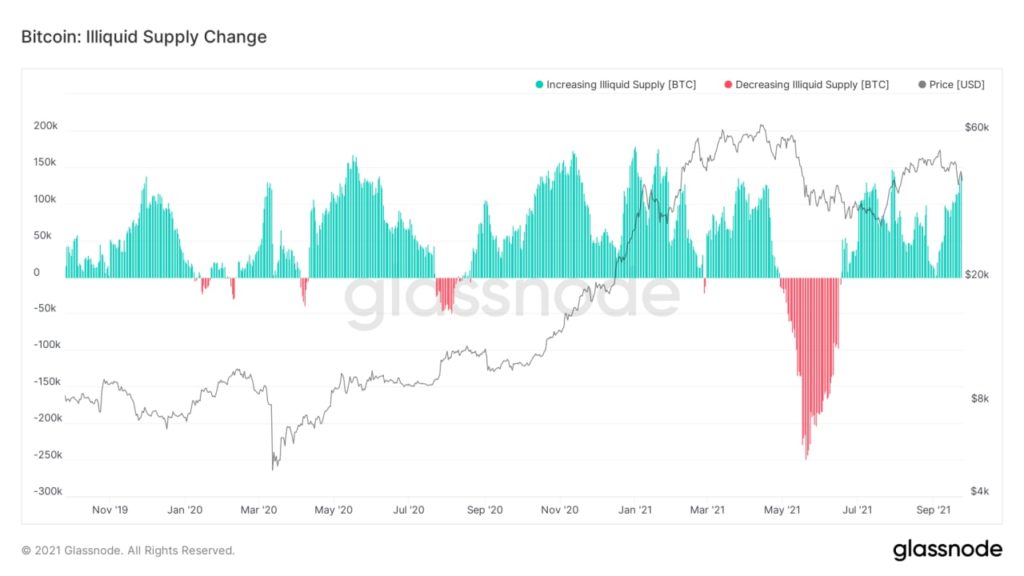

In sharp contrast to leveraged retail traders, long-term hodlers of BTC remain unfazed with the FUD and dip and are continuing to add to their stack as can be seen in the below diagram. After selling in May, these long-term hodlers are accumulating BTC at a more aggressive pace since the early Sept selloff.

Financial Institutions Prefer ETH Over BTC

Meanwhile, as BTC supporters continue to acquire more BTC, supporters of ETH claim that ETH is a better store of value than BTC. While corporates and sovereign states prefer hodling BTC, financial institutions seem to favor recommending ETH to their clients. After Goldman Sachs in May, now JP Morgan is recommending ETH over BTC as a store of value to their clients in an investment note published at the end of last week. In the report, JPM described ETH as the “Amazon of information” and has more use cases than BTC.

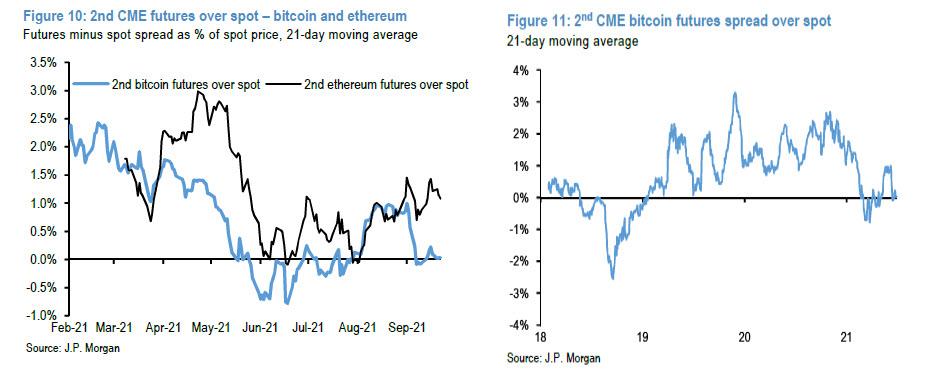

One interesting fact JPM points out is that market participants are more bullish on ETH than BTC by comparing the futures over spot price of both assets. In a bullish market, futures price should be higher than spot price due to inflation and perceived higher demand of the commodity with time. JPM noted that while ETH trades in contango where futures price is higher than spot price, BTC futures does not trade at a premium to spot price, implying that investors are not as bullish on the asset.

Crypto Adoption Continues, AMC Finally Accepts DOGE

While the US SEC Chairman Gary Gensler continues to talk bad about the crypto industry and likened stablecoins to casino chips, other countries do not seem to concur with the way he thinks. One such country is Dubai – the Dubai World Trade Centre announced on Wednesday that it has entered an agreement with its Securities and Commodities Authority to support the trading of crypto assets in its free zone.

Other good news continues to fill the space as Dutch Football giant PSV announced that it is now holding BTC on its balance sheet. Another noteworthy news is that Robinhood will finally be rolling out its crypto wallet service for users, which will be very welcome news for DOGE holders as they had been petitioning the exchange for wallets so that they can withdraw their DOGE for use. This could be good for the price of DOGE as many DOGE holders on Robinhood had been selling their DOGE as a protest to buy back lower at other exchanges. The rollout of this wallet may remove the selling pressure on the token. The good news keeps coming for DOGE as AMC Theatres has also agreed to accept DOGE as payment after first announcing that it will accept BTC, ETH, LTC and BCH last week.

However, all the good news in the world still could not overcome the negative impact caused by China due to the large number of crypto investors from China. On Saturday, the biggest Chinese exchange Huobi announced that it will terminate services to all China users by the end of this year. More such termination is expected to come from other foreign exchanges over the course of the week, which may continue to add pressure on the crypto market at a time when even the traditional market continues to be plagued by worries over the Evergrande contagion.

However, by Sunday, rumors out from China about the Chinese community moving from centralized exchanges to decentralized exchanges sent the prices of decentralized exchanges soaring. DYDX saw a massive gain of 65% overnight and UNI also made a fantastic gain of around 40%. The sudden optimism spilled over to the rest of the market, which saw the price of ETH pop pass $3,000, and BTC has also rebounded above $44,000. However, it remains to be seen if the rebound can be sustained, or that it could be yet another dead cat bounce, as another inflow of BTC to exchanges was spotted on-chain just a few hours ago. Whether or not this inflow will bring the market back lower will likely be seen over the next few days.

About Kim Chua, Noble Pro Trades Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

Risk Disclaimer:

Investing in or trading gold or other metals can be risky and lead to a complete loss of capital. This guide should not be considered investment advice, and investing in gold CFDs is done at your own risk.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities, and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of Noble Pro Trades. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Noble Pro Trades recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.